In spite of the lack of visibility and challenging socio- economic conditions caused by the Covid 19 pandemic, the Group reported revenue of MUR 315.8Mn, an increase of 58.6% on FY2020 and Group profit after tax from continuing operations reached MUR 23Mn compared with MUR 1.2Mn in FY2020. This performance has been achieved thanks to our continuing engagement with our customers over the years and on the back of strong resilience and agility from all lines of business.

Much of revenue growth was driven by Enterprise IT and related activities with revenue from local IT projects increasing by 67% to MUR 250Mn whilst on the international front, revenue increased to MUR 14.8Mn, up by 51%. The completion of a hotel project in Seychelles contributed to revenue of MUR29.4Mn for the engineering consultancy operations, an increase of 6.1% compared with last year. The Fintech companies collaborated with a sister company in a digital transformation project and this line of business generated revenue of MUR 20Mn, an increase of 7% on last year.

Total administrative and operating expenses amounted to MUR 74.8Mn which includes a charge of MUR 2Mn relating to application of IFRS 16 Leases for the office building, represents an increase of 3% compared to last year. Except for staff and related costs which increased by 11%, other item of expenses were largely contained after implementation of cost savings measures right at the outbreak of the pandemic. Profit from operations increased sharply to MUR 24.9Mn from MUR 1.7Mn in FY2020 despite pressure on our margins. The profit after tax of MUR 23Mn represents a major increase in profitability compared with MUR 1.2Mn achieved in FY2020.

InfoSystems Group

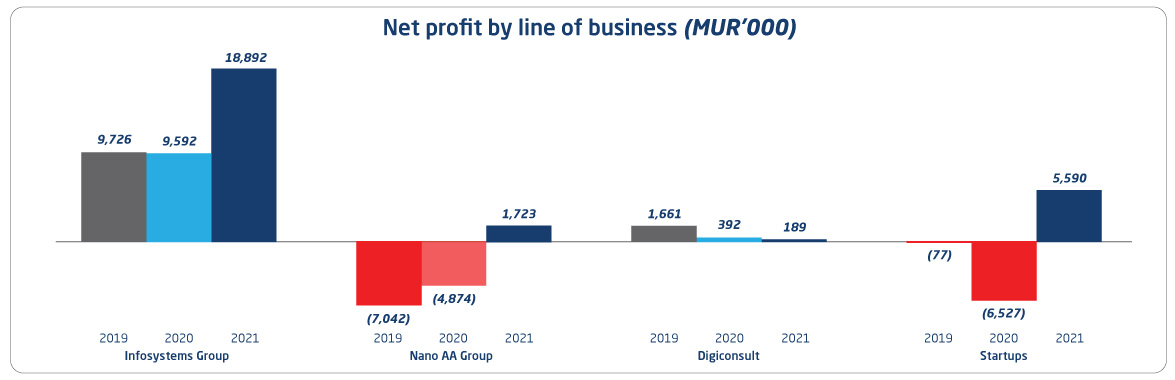

A few large contracts were secured with key clients operating mainly in the Banking and Telco industry during the year and this contributed signicantly to the revenue increase. All departments registered increases of 55% on average. The infrastructure department, being the largest and key revenue generating business contributed around 58% of total revenue which reached MUR 250Mn. Revenue from the Zambia subsidiary represented 6 % of the group revenue. Total administrative and operating expenses were MUR 24.2Mn, a decrease of 4% from last year. Net profit margin decreased from 8.3% to 7.5% due to a slight decrease in gross margin and increases in operating costs. Group profit after tax was MUR 18.9Mn representing an increase of 97% compared with last year.

DigiConsult

The engineering consultancy activities were directly affected by the disruptions caused by the Covid lockdowns due to its heavy dependence on the hotel sector, albeit a key project overseas which started in FY2018 was successfully completed. This was an important milestone which contributed to revenue of MUR 29.8Mn for FY2021, an increase of 49.7% compared with FY2020. The profit for the year was marginal having been largely impacted by staff costs, support fees and other operating expenses which increased by 80% to MUR 35.1Mn.

Nano AA Group

Revenue from Fintech activities and digital consultancy services grew by 10% to reach MUR 20.4Mn. Total administrative and operating expenses including pre-operational expenses incurred were MUR 16.3Mn, a decrease of 29% explained mainly by a decrease in staff costs resulting from the streamlining of operations initiated in the latter part of FY2020. Around the end of the financial year, the digital financial inclusion platform developed in-house neared completion and a number of projects and initiatives in RegTech had already been launched. Thus, investment in R&D and new technologies to build up our digital capital and capabilities continued during the year resulting in MUR 5Mn being capitalised. The group achieved an improved performance this year over last year and reported a profit after tax of MUR 1.7Mn.

EC3and Sustainable ALTernative Consultancy [S.Alt]

Our startup, EC3 AA Ltd, operating in the PropTech space completed a project for a large local group engaged in retail mall operations, whilst the newly incorporated company, Sustainable ALTernative Consultancy Ltd (S.Alt), started providing LEED certification services to customers. It is expected that demand for new technologies in these areas will bolster growth for these companies in future.

Gearing and equity

At 30 June 2021 total borrowings and lease liabilities were MUR 23.3Mn representing 19% of equity which amounted to MUR 124.7Mn, an increase of 19% from FY2020.

Liquidity

Cash generated from operations were MUR 31.4Mn and MUR 5.9Mn were received as proceeds from bank borrowings during the year. There has been an increase of MUR 17.3Mn of cash during the year and at year end the group held MUR 47.4Mn as cash resources.

Dividend

A dividend of MUR 5Mn has been declared to the shareholder, The Anglo African Foundation (TAAF).

The year ahead

With gradual resumption to 'new normal' brought about by the opening of the borders and the easing of restrictions, general business sentiment appears to have improved yet we remain cautious. At the time of writing this report, the group has already secured a major IT infrastructure project, and the first fully licenced digital financial inclusion platform is expected to be launched by end of 2021 in collaboration with our partners.

The next financial year will be full of challenges as we continue to diversify and transform our business, thus we anticipate an eventful year and another year of excellent performance.

Jean Pierre TCV Chay Loong

Chief Finance Officer

29th September 2021