Directors in the Subsidiaries

The policy of the Group is to appoint the General Manager of the subsidiary and at least one director from the holding company on the board of the subsidiaries.Click here to learn more

Profile of Directors

The profile of all Directors. Click here to learn more

Conflict of Interest

The directors and staff are encouraged to self-declare conflicts of interest and if applicable, withdraw from the decision-making process.

The Board and management team are responsible for managing conflict of interest situations in order to ensure that the workplace behaviour and decision-making throughout the Group are not influenced by conflicting interests. Policies regarding gifts and hospitality offered have been communicated to staff.

Ethics and Business Conduct

The Group is committed to abide by the highest standards of ethical and professional integrity, based on a fundamental belief that business should be carried out honestly, fairly and legally. Our Code of Conduct, which encompasses our ethical practices, anti-bribery rules, data protection and confidentiality norms amongst others, is intimated to employees upon joining as part of their employment conditions.

The Company takes any allegations of solicitation of bribes or any corrupt practices very seriously. As such, any of these allegations are escalated directly to the CEO who will then decide, based on recommendations from the Internal Executive Committee and external (Legal advisor) counsel, whether to refer it to the Disciplinary Committee and eventually relevant enforcement authorities.

Statement of Remuneration Philosophy

As from January 2016, on the recommendation of the Corporate Governance, Remuneration and Nomination Committee, non-executive directors are paid a fee for attending As from January 2016, on the recommendation of the Corporate Governance, Remuneration and Nomination Committee, non-executive directors are paid a fee for attending Board meetings and Committee meetings. The Chairman of the Board and Chairman of the Committees are paid a higher fee. Executive directors are in full-time employment of the Group and do not receive additional fees for sitting on the Board or the Committee meetings.

The remuneration policy for management and staff is to reward effort and merit as fairly as possible. Other factors considered include experience, qualifications, skills scarcity, responsibilities shouldered and employee engagement. The General Manager of each subsidiary is also incentivised through a profit sharing scheme based on the profitability of the subsidiary and the achievement of set key performance indicators (KPIs).

Auditors Remuneration

The fees payable to the Group external auditors, Kemp Chatteris, for audit services amounted to MUR 410,000 (2020: MUR 362,000). No fees were paid to them for non-audit services.

Contracts of Significance

There was no contract of significance subsisting during the year to which the Company or any of its subsidiaries was a party to and on which a director was materially interested either directly or indirectly.

Internal Control and Internal Audit

The Board is responsible for the system of internal control and risk management. Management is responsible for the design, implementation and monitoring of the internal control systems. In view of the size of its operations, the Group did not have an internal audit department.

Related Party Transactions

Related party transactions are disclosed in Note 23 to the financial statements. Click here to learn more

Corporate Social Responsibility and Other Donations

The Group contributed MUR 115,580, representing 25% of its CSR fund, to 3 NGO’s focused on helping underprivileged and vulnerable children across Mauritius, namely:

(i) Muscular Dystrophy Association (MDA),

(ii) Medcare Academy (MA) and

(iii) Adolescent Non Formal Education Network(ANFEN).

The remaining 75% of its CSR fund was remitted to the Mauritius Revenue Authority as required under the Income Tax Act.

Health, Safety and Environment Policy

The Group has issued a Workplace Safety Rules handbook that is provided to all staff. The handbook is regularly updated. The Group is committed to:

- Provide a safe workplace and ensure that personnel are properly trained and have appropriate safety and emergency equipment.

- Conserve natural resources by reusing materials, purchasing recycled materials, and using recyclable packaging and other materials.

- Market products that are safe for their intended use, efficient in their use of energy, protective of the environment, and that can be reused, recycled or disposed of safely.

- Ensure the responsible use of energy throughout our business, including conserving energy, improving energy efficiency and giving preference to renewable over non-renewable energy sources when feasible.

Dividend Policy and Dividend Declaration

The Company has not adopted a formal dividend policy.

The Company has declared and paid a dividend of MUR 5 million for the year ended 30 June 2021 (2020: MUR 5 Mn).

King Code IVTM

We have adopted King Code IVTM in our Integrated Report and how we “Apply and Explain”, ourselves against the 16 Principles of the code, noting that principle 17 is not applicable to us. Click here to learn more

Our Integrated Reporting exercise is a voluntary one as we are not subject to any National Code of Corporate Governance. So, we have decided to adopt and report on what we believe to be the most recognised and comprehensive Code in Africa and Asia. Abiding by such standard would increase the trust placed in the Anglo African brand by stakeholders in various jurisdictions.

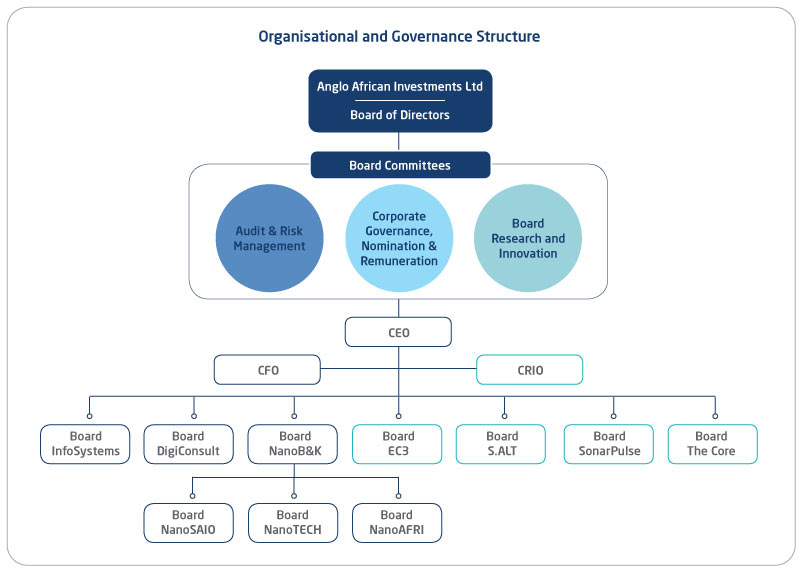

Legal and Shareholding Structure

Anglo African Investments Ltd is a private company limited by shares. The share capital of the Company consists of 1,000 ordinary shares of MUR 100 each and is held by The Anglo African Foundation. Click here to learn more on the Group Structure